The Politics of Investing

By Andrew Willms, The Milwaukee Company

There is no shortage of political issues that are weighing heavily on Wall Street as of late. The stock market has been whipsawed up and down by news regarding the Supreme Court vacancy caused by the passing of Ruth Bader Ginsburg, the stalemate in Congress over a new stimulus package, and the strain the TikTok debacle is putting on U.S.-China relations, to name a few.

The most significant political issue impacting the market at present is the upcoming presidential and congressional elections. That said, a recent study by Vanguard found that the average returns of a 60% stock/40% bond portfolio is virtually the same during Presidential election years (8.9%) as it is in non-election years (8.1%).

Even more surprising is the study’s finding that market volatility tends to be lower than its historical average before and after an election. More specifically, from January 1, 1964 to December 31, 2019 the annualized volatility of the Standard & Poor’s 500 Index’s annualized volatility was 15.7%, Vanguard reports. By comparison, during the 100 days before and after a presidential election, annualized volatility was 13.8% in those years.

Vanguard summarized the results of their study as follows:

Election years can be fraught with uncertainty as developments surrounding the candidates, their platforms, and their predicted effects on the economy and markets dominate the news. But should you let this stream of political information influence how you and I manage your investment portfolio? A lengthy history of empirical research suggests not.

Then again, averages often do not tell the whole story, and not all election years are created equal. One would not expect the election’s outcome to have much of a market impact in those years where the incumbent party wins, the outcome is clear in advance, or neither party’s policies are regarded by investors to be significantly more beneficial or detrimental to the market’s outlook.

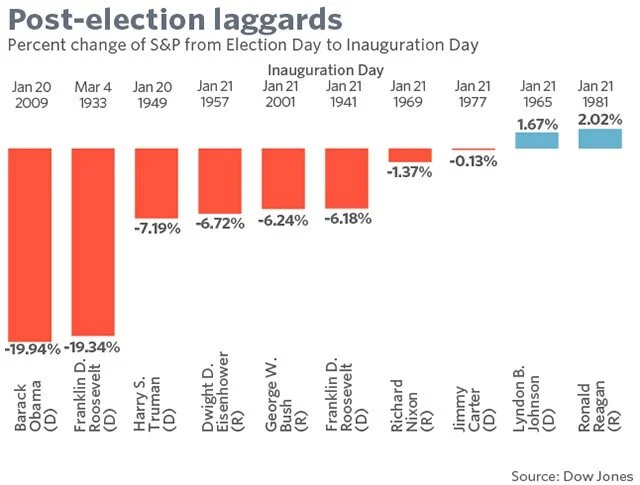

At the same time, history also provides plenty of examples where elections appeared to have a major impact on the stock market. Most recently, the stock market fell nearly 20% between President Barack Obama’s election on November 4, 2008 and his swearing in on January 20, 2009. However, the economy was in the midst of a recession at the time he was elected, which likely played a major role in the sell-off.

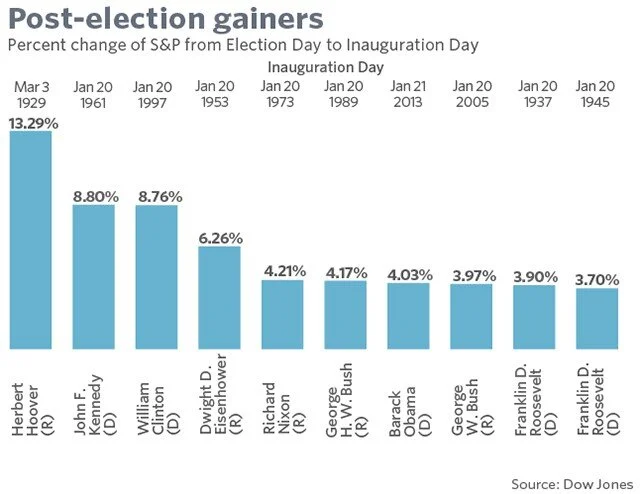

As the charts below from MarketWatch illustrate, Presidential elections can be accompanied by major swings in stock prices.

In short, elections often do not have a major impact on Wall Street, although the potential for trouble is always lurking. The magnitude, it seems, depends in large measure on what’s at stake for investors.

One could intelligently argue that with all the other factors that are currently affecting the stock market (including the economic disruption caused by the Covid-19 pandemic, the Federal Reserve’s steadfast commitment to keep interest rates low, and the ongoing Chinese-American trade war), it is unlikely that the election’s outcome will be a catalyst for lasting change in the market’s course.

On the other hand, the stakes have seldom been higher for investors, given the wide chasm between the Democrats and Republicans on a number of market-moving issues such as taxes, international trade, government regulation, and how best to deal with the Covid-19 pandemic.

While we all have our personal preferences on the coming election, experience has taught me that political views should have little influence on investment decisions.

For example, many conservative investors feared that President Obama’s election would lead to the mother of all bear markets and repositioned their portfolios accordingly. Instead the market rose 148% during Obama’s eight years in office.

Similarly, the politically liberal hedge fund manager George Soros is estimated to have lost nearly $1 billion on bets made based on his strongly held belief that President Trump’s election would lead to a stock market apocalypse. As it turned out, the stock market rallied after Trump’s election and has risen approximately 40% during his tenure so far.

As difficult as it is to make a sound forecast on who will win a close election, that task pales in comparison to the difficulty of intelligently forecasting how an election will impact your portfolio. So why bother? If you want to bet on the election outcome, you may be better off doing so at a casino than on Wall Street.